There has been a vast increase in new startups being founded, mainly because it’s easier than ever before in history. An estimated 137,000 startups are founded every day (Worldwide Business Start-ups, Moya K. Mason) while about 120,000 get dissolved at the same time. Companies like Amazon, Google, Salesforce, Intuit, Box, and a good dose of Eric Ries’ Lean Startup methodology have made it possible for entrepreneurs to start a company with just a few thousand dollars (or even less). Mature ecosystems like Silicon Valley, Tel Aviv or London have seen their share in startup creation in literally every niche; and almost every idea has been turned into a business. However it is not about quantity, it’s about quality. And let’s not forget that 88% of startups fail.

Startups fail for many reasons: team, business model, niche/target market, product, design, and most often execution. I have seen so many startups that had almost all the elements needed to transition into a sustainable, high-growth business, but were lacking guidance, advice – and often an experienced leadership team. Building a startup is difficult – converting it into a high-growth business is even more difficult, and often requires a different skill set than in the early days of a startup.

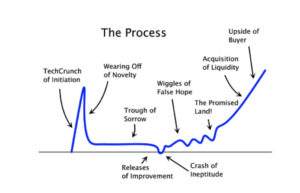

The Long March (credits: GoingLong, and Tom Fishburne)

The right mentors are a critical success factor for a startup

In the first research report by the Startup Genome Project in 2011, supported by UC Berkeley and Stanford, the authors analyzed why startups succeed or fail. Data from 650+ startups was analyzed, including 160 funded companies. Two of the core findings were:

- Founders that learn are more successful: Startups that have helpful mentors, track metrics effectively, and learn from startup thought leaders, raise 7x more money and have 3.5x better user growth.

- Startups that pivot once or twice raise 2.5x more money, have 3.6x better user growth, and are 52% less likely to scale prematurely than startups that pivot more than 2 times or not at all.

Startups need the right mentors and advisors in order to raise money when they need to scale. And – in order to scale – startups are likely to pivot once or twice. Or, as Eric Ries puts it: “Startup success can be engineered by following the process, which means it can be learned, which means it can be taught.”

Advice widely available for early-stage startups

When I founded my last startup, 3scale, back in 2007, there was much less support for early-stage startups than today. There were some incubators, but the accelerator concept was relatively new – although Y Combinator started in 2005, TechStars had their first batch in 2007, 500 Startups launched in 2010. Things have changed. Today startups can choose from a wide variety of incubators, accelerators, business angel (networks), university support, etc. who help especially in the early days from idea to seed stage.

StartupCompass (part of the Startup Genome Project) published a widely respected structure that clusters the stages of a Startup Lifecycle:

1) Discovery (MPV, initial validation and value proposition)

2) Validation (early business model validation, beta tests, pivots)

3) Efficiency (business model refinement, customer acquisition channels and process)

4) Scale (high-growth, scalability, organizational changes and management systems)

5) Sustain

6) Conservation

Advice seems to be widely available especially for the Discovery and Validation phases. After a startup has gone through an accelerator and has potentially closed a successful seed round, the availability of advice is more limited. Lucky if the startup was able to raise money from a top-tier (brand) VC with a dedicated investment manager who is opening doors, is supportive and spot on (=smart money). However “smart money” is the exception.

Different mentors are required for growth-stage startups

While advice and support for the Discovery and Validation stages have been covered by incubator and accelerator programs, the knowledge and skills required to build sustainable high-growth startups, post seed stage, are very different, and relate to the difficulty of many startups to raise a Series A round (Series A crunch).

It is highly recommended that the advisors and mentors are not only a functional fit, but also have very specific industry knowledge which they can share with their mentees – or open doors to that industry. Example: For a growth-stage, mobile payments startup, you would want to have advisors from the mobile carriers, handset manufacturers, but also traditional and digital payment solution providers (industry and functional fit).

Paul Graham’s Startup Curve – avoid the “through of sorrow”!

Some of the core competencies for startup mentors may remain the same: marketing experts, investment advisors, UI/UX experts, product designers. However there are some functional areas that most growth-stage companies need support with (Efficiency, Scale stage and beyond):

- Organizational structure (roles & responsibilities, departments, key hires, incentive system)

- Management systems (financial planning & evaluation, HR planning & evaluation, strategic planning, product development management, sales/marketing management, partnership management)See also ‘Building Sustainable High-Growth Startup Companies: Management Systems as an Accelerator’, by Antonio Davila, George Foster, Ning Jia

- (International) expansion (product vs. geographical expansion strategy)

- Strategic alliances and partners (obtaining targeted resources, JV, channel collaboration)

- Buy vs. Build (organic growth, M&A, software rental, IP protection)

- Channel management and enterprise sales (viral, bottom-up user adoption, lead generation, enterprise learning, support)

- And especially how to ensure sustainable growth (business model, retention strategies, excellence)

This is not trivial. Large corporations face similar challenges. Indefinite growth is not common, most companies face growth stalls. See ‘Stall Points’ by Matthew S. Olson and Derek van Bever or the HBR article “When Growth Stalls” by the same authors.

This excellent research demonstrates that the vast majority of stall factors result from a choice about strategy or organizational design. In other words: they are controllable by management.

Although the identified reasons why a Fortune 500 firm may stall are not fully applicable for startups, they have one thing in common: the startup management, together with their board and advisors control these factors. It is the leadership responsibility to seek advice, leverage internal and external resources, and develop capabilities to build a sustainable, high-growth company.